Use Form T777 to calculate your allowable employment expenses. Include Form T777 with your income tax and benefit return.

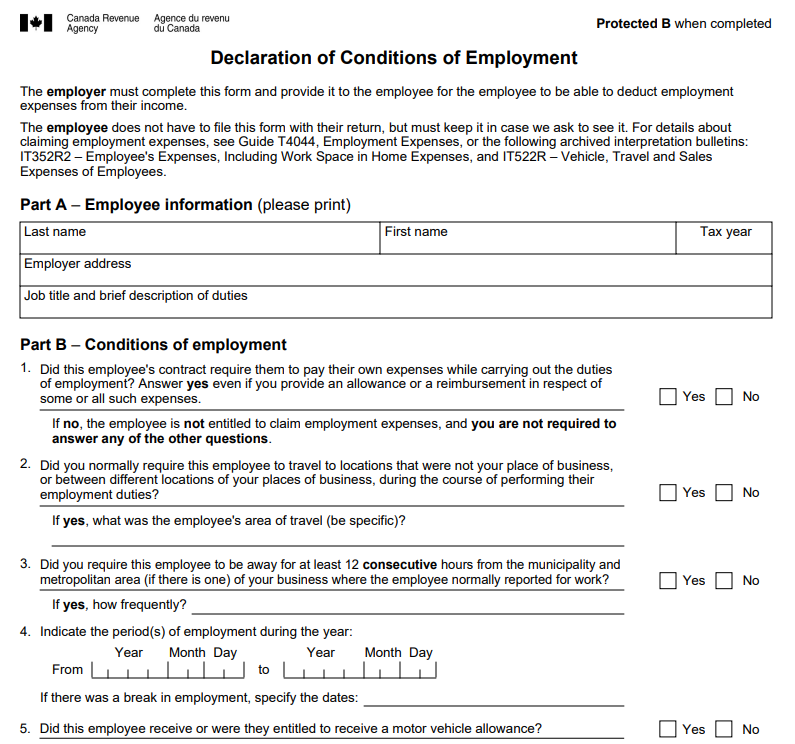

A T2200 form is a Declaration of Conditions of Employment in Canada. It is used by employees to claim work-related expenses on their tax returns. The form must be signed by the employer and indicate the expenses the employee incurred while working and the reason why they are necessary. The following expenses may be eligible to be claimed on a T2200 form:

It is important to note that the expenses must be reasonable and directly related to the employee's work duties. The Canada Revenue Agency (CRA) may disallow expenses if they do not meet these criteria.

Read more at - https://www.canada.ca/en/revenue-agency/services/forms publications/publications/t4044/employment-expenses.html

Have questions on your eligibility or if the expense can be claimed? Want to know more on how to file and claim in general?

Contact us by calling 604-373-0788, emailing us at commercial@ctpros.ca or by simply filling in the contact form

Disclaimer: This article only provides general information which is not construed as professional advice. Readers seeking professional advice must consult an experienced and a qualified professional in the respective field.