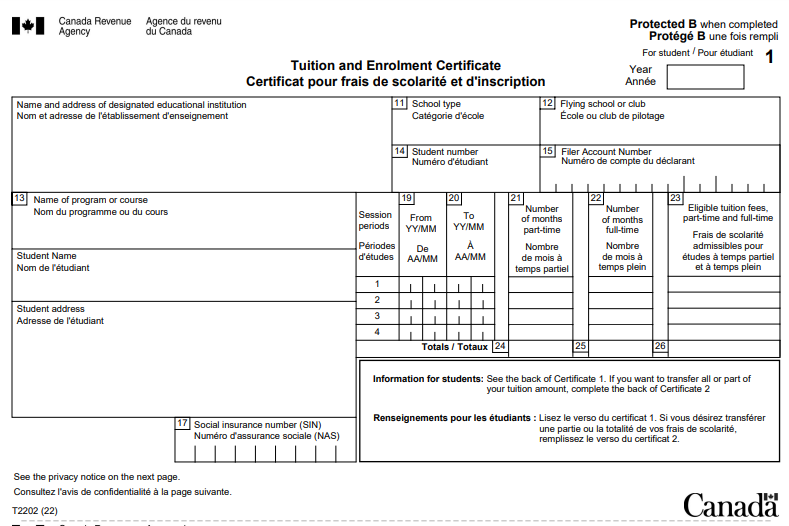

The T2202 form is a tax form used in Canada to report tuition and education amounts paid by a student to claim the tuition tax credit. The amount of tuition fees reported on the T2202 form depends on the specific school and program that the student is enrolled in.

This is an important credit especially for new immigrants to Canada on student visa. Even if you don't work in the first year of arrival into Canada, it is important to file your new immmgrant taxes in Canada along with the T2202 credit slip. These unused tax credits can either be carried forward for future years to offset future taxes or transfer in the current year upto $5,000 of tuition tax credits to the spouse who is on a working visa (such as an open work pemit or other) to reduce the family tax liability.

In general, tuition fees in Canada can range anywhere from $5,000 to $15,000 per academic year, depending on the type of institution and program. Some of the top universities in Canada, such as the University of Toronto and McGill University, have higher tuition fees, whereas some colleges and trade schools may have lower fees.

It's important to note that tuition fees are subject to change from year to year and are not set by the Canadian government. They are determined by each individual institution and can vary based on several factors, including the type of program, the location of the institution, and the reputation of the institution.

Tax payer has to complete Schedule S11 to calculate the federal tuition, education, and textbook amounts and Canada training credit, current-year unused tuition amount available to transfer to a designated individual, and unused federal amount available to carry forward to a future year.

Read more at - https://www.canada.ca/en/revenue-agency/services/forms-publications/forms/t2202.html

Have questions on your eligibility or if the credit can be claimed? Want to know more on how to file and claim in general?

Contact us by calling 604-373-0788, emailing us at commercial@ctpros.ca or by simply filling in the contact form

Disclaimer: This article only provides general information which is not construed as professional advice. Readers seeking professional advice must consult an experienced and a qualified professional in the respective field.